Get Pen2Print services from our Educational Platform for scholars.

Pen2Print Services for Scholars

We provide wide range of services to our authors and scholars around the world.ISBN no for Conferences

ISBN no. for your upcoming conference, seminar or workshop

Edited Book Publication

Get your edited book published through us. Send the draft of the edited book or proposal

Book Publication with Pen2Print

Book Publication with ISBN no. for authors and scholars around the world.

Conference Proceedings Publication

Publication of Conferene Issues and Proceedings.

We have Delivered

1100

Published Books

250

Edited Books

350

Confernce Proceedings

50

On Progress Projects

Services

Education

Our Services.

A Publishing agency that believes in the power of Academic Support to Scholars.Search more articles

Featured post

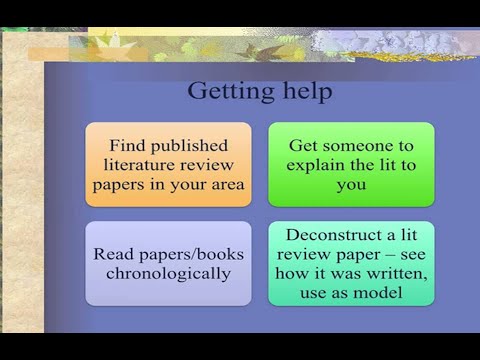

How to Write Effective Literature Review

A literature review is an essential component of any research project or academic paper. It involves identifying, evaluating, and summarizin...

Book Chapters

Popular

-

Mastering the Art of Saving Saving money is a skill, and like any skill, it needs practice and fine-tuning to reach perfection. Whether yo...

-

At first glance texting and interviewing candidates seems to go together as well as ketchup and lobster. But if you think about it just a mi...

-

A visit to a historical monument is always an exciting experience. It is a fascinating adventure. I had one such experience during the last ...

-

Talking about our most crucial resource “Water” , our rivers, lakes, seas are flooding with chemicals, waste, plastic, and other pollutants....

-

A visit to a historical place is always an exciting experience. It is a fascinating adventure. I had one such experience during the last sum...

Services Tags

- Articles

- Audio Books

- Awards

- Biography

- Book Chapter Publication

- Book Chapters

- Book Chapters Publication

- Book Publication

- Book Publishing

- Book review

- Book Series

- Book-Chapters

- Book-Cover-Design

- Books

- Call for Book Chapters

- Call for Papers

- Chapters

- Conference

- Conference Proceedings

- Conference-Proceedings

- Conferences

- Content Writing

- Copywriting

- Creative Writing

- Edited Books

- Edited-Books

- ISBN

- Marketing

- Pen2Print

- Pen2Print Publication

- Pen2print Services

- Physical Educational Books

- Printing

- Publications

- Publisher

- Publishing

- Research

- Research Papers

- Research Publication

- Reviews

- Top Books

- Website Development

- Writing Services

Powered by Blogger.

Readers of the Forum

Search This Website

Archives

Pen2Print

We provide book and book chapters publication services

Call for Papers

Send request for services to editor@pen2print.org

Send manuscript for book publication to editor@pen2print.org

Pages

Pen2Print Services for Scholars

Get More

Copyright ©

Pen2Print Services