Abstract:

Despite

the tremendous growth in some Asian Countries, unemployment, poverty and

inequality still remain issue in most of countries in general and India in

particulars. Many economies tried hard to break vicious circle of these

problems by adopting numerous strategies but the success is yet to come. The

failure of trickledown effect is major cause for failure of many strategies at

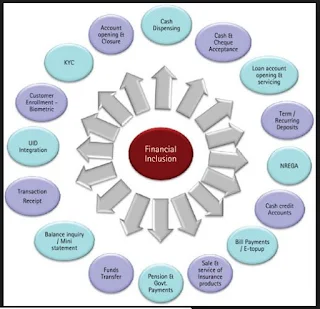

local or national or international level. Financial inclusion which is integral

of inclusive growth process and sustainable development is a strategic tools

for providing, access to financial services in form of savings, loans,

insurance, credit and payment to needy, low income and unprivileged people of

society. So objective of the paper is to analyse impact of financial inclusion

in rural and urban area of Gohana Block of Sonipat District in Haryana.

Key

Words: Financial Inclusion, Poverty, Inclusive Growth, Development, Sonipat

1.

Introduction

Despite the tremendous

growth in some Asian Countries, unemployment, poverty and inequality still

remain issue in most of countries in general and India in particulars. Many

economies tried hard to bread vicious circle of these problems by adopting numerous

strategies but the success is yet to come. The failure of trickledown effect is

major cause to for failure of many strategies at local or national or

international level. Financial inclusion which is integral of inclusive growth

process and sustainable development is a strategic tools for providing, access

to financial services in form of savings, loans, insurance, credit and payment

to needy, low income and unprivileged people of society. In this way financial

inclusion refers a process that insures the ease of access, availability and

usage of the formal financial system for all member of the economy. It

facilitates efficient allocation of productive resources and reduces the role

of informal sources of credit as money lender which are found to be exploitive

in economy.

In India the concept of financial

inclusion was first incorporated 2005, when it was introduced by K.C

Charoborty, The chairman if Indian bank and Mangalam village turn out to be

first village in India where all household were provided banking facilities.

National Rural Employment Guarantee Programme is a mile stone for the promotion

of financial inclusion as the necessary requirements of channelling the wage

payments through the banking system so that we can evaluate the problems of

corruption, redtapism etc and real fruit of development of a country reach to

poorest people. It is estimated that

around 2.9 billon people around the world do not have access to formal sources

of banking and financial services. India is said to be lived villages with

around 72% population however a significant proportion of our villages does not

have single branch in rural areas (RBI, Working Paper 2015).

So

objective of this study is to analyse a comparison of impact of financial

inclusion on urban and rural areas. The paper is organised as follow, Section 1

deals with review of literature which put a light on previous work of financial

inclusion as national and international level and provides a gap to researcher

for further research, Section 2 explores the objectives of the study and section

3 described research methodology. Section

4 represents the main findings of work and the last section 5 captured conclusions

and suggestion for further policy implication.

2.

Review of Literature

Review of literature helps the researcher

not only in understanding the issues involved but also in planning and

execution of the experiences of others. Further, the knowledge of possible gap

of empirical research provides clue to plug those gaps to the extent possible

which in turn helps in making empirical research socially more meaningful. The

main objective of the study is to impact of financial inclusion in Gohana Block

of Sonepat District. So, we briefly review some of the earlier studies on financial

inclusion to identify gaps in research, if any, which would help in formulating

the methodology of present study and brief review of some studies, is given

below.

Thorat (2007)1 explained

experience of financial inclusion in India. The study based on secondary data

using source RBI. The study describes many phenomenon of financial inclusion in

India like how to measure financial inclusion, initiatives of reserve bank of

India for financial inclusion and also focus on strategies and approach. The

approach to financial inclusion in developing countries such as India is thus

somewhat different from the developed countries. In the latter, the focus is on

the relatively small share of population not having access to banks or the

formal payments system whereas in India.

Swain

(2008)2 analysed current Indian framework of financial inclusion.

The study based on secondary data using source NSSO and RBI. The study attempts to develop a framework

inclusion well within the propositions of the current Union Budget which is

expected to work for the Indian scenario .It also tries to hit on several flaws

in the current mass debt waiver policy for farmers announced in the Union

Budget and its implication. Within such policy, framework, the study is an

attempt to weave an argument starting from the mismatch of credit and deposit

growth of banks, steps taken by the Reserve of India, role of IT as an enabling

agent, role of government, future challenges and how all this has shaped the

present degree of inclusion of India.

Massey

(2010)3 discussed the role of financial institutions in a developing

country is vital in promoting financial inclusion. The study is based upon

secondary data. The study shows that efforts of the government to promote

financial inclusion and deepening can be further enhanced by the pro-activeness

on the part of capital market players including financial institutions.

Financial institutions have a very crucial and a wider role in fostering

financial inclusion. National and international forum have recognized this and

efforts are seen on domestic and global levels to encourage the financial

institutions to take up larger responsibilities in including the financially

excluded lot.

Sharma (2010)4 analysed

the index of financial inclusion. The study based on secondary data. The study shows promotion of an inclusive

financial system is a policy priority in many countries. While the importance

of financial inclusion is widely recognized, the literature lacks a

comprehensive measure that can be used to measure the extent of financial inclusion

across economies. The study attempts to fill this gap by proposing a

multidimensional index of financial inclusion (IFI). The proposed IFI captures

information on various dimensions of financial inclusion in one single number

lying between 0 and 1, where 0 denotes complete financial exclusion and 1 indicates

complete financial inclusion in an economy. The proposed index is easy to

compute and is comparable across economies.

Damodar (2011)5 explained

issues and challenges of financial inclusion in India. The study shows that a

vast segment of India's population exists on the margins of India's financial

systems. There is growing concern about people being ‘under-banked’. Financial

inclusion is important priority of the country in terms of economic growth and

development of society. It enables to reduce the gap between rich and poor. It

helps to channelize money-flow to the economy; it ensures people who are unable

to access financial system so far can access it with ease. The study discusses

the role of financial inclusion in the economy and how the different

stakeholders play an important role in developing the whole initiative.

Dangi and Kumar

(2013)6 evaluated current situation of financial inclusion in India

and its future visions. The study based on secondary data using source RBI

Bulletin, Annual Reports of RBI and Ministry of Finance, NABARD, Government of

India. The study focuses on the RBI and government of India initiatives and

policy measures, current status and future prospects of financial inclusion in

India on the basis of facts and data provided by various secondary sources.

This study concludes that financial inclusion shows positive and valuable

changes because of change in strength and technological changes. Therefore,

adequate provisions should be inherent in the business model to ensure that the

poor are not driven away from banking. This requires training the banks

forefront staff and managers as well as business correspondents on the human

side of banking.

Kukreja

and Sharma (2013)7 explained relevance

of financial inclusion for developing nations. The study based on secondary

data using source Research Journals, E-Journals, RBI Report, and Report

of NABARD. This study shows the basic features of

financial inclusion, and its need for social and economic development of the

society. The study focuses on the role of financial inclusion, in strengthening

the India’s position in relation to other countries economy. The results of study show that financial

inclusion is playing a catalytic role for the economic and social development

of society but still there is a long road ahead to achieve the desired

outcomes.

Paramasivan and Ganeshkumar (2013)8

discussed overview of financial inclusion in India. The study based on

secondary data using source World Bank. The study shows that inclusive growth

is possible only through proper mechanism which channelizes all the resources

from top to bottom. Financial inclusion is an innovative concept which makes

alternative techniques to promote the banking habits of the rural people

because, India is considered as largest rural people consist in the world.

Financial inclusion is aimed at providing banking and financial services to all

people in a fair, transparent and equitable manner at affordable cost.

Households with low income often lack access to bank account and have to spend

time and money for multiple visits to avail the banking services, be it opening

a savings bank account or availing a loan, these families find it more

difficult to save and to plan financially for the future.

Shastri

(2014)9 discussed the role of financial inclusion in Madhya Pradesh with

reference to Rural Population. The

objective of the study is to check financial inclusion in rural areas of Ujjain

District, reasons for low inclusion and satisfaction level of the rural people

towards banking services. The study has critically analysed the issues and a

challenge involved in financial inclusion for inclusive growth and has also

successfully attempted to highlight the factors that can aid in achieving

financial inclusion for inclusive growth.

Tamilarasu (2014)10 explained role of

banking sectors on financial inclusion development in India. The study based on

secondary data using source RBI data related to commercial banks. This

study shows that financial inclusion growth is possible only through proper

mechanism which channelizes all the resources to all the direction of the

customers. It is an innovative concept which makes alternative techniques to

promote the banking habits of the rural people. Because India is considered as

largest rural populations in the world and belongs to agriculture activities,

financial inclusion is aimed at providing banking and financial services to all

people in a fair, transparent and equitable manner at affordable cost.

Hastak and Gaikwad (2015)11 explained issues relating to financial inclusion and banking

sector in India. The study based on secondary data using source RBI and

Financial Excess Survey IMF. This study

shows that need and importance of financial inclusion for the social and

economic development of India. The study also reviews the current scenario as

well as current and future plans of RBI for Financial Inclusion. After analyzing

the facts and figures it is concluded the, though, various steps are taken by

RBI and Government of India to improve financial inclusion there is a long way

to achieve the total financial inclusion.

Barua, Kathuria, and Malik (2016)13 discussed the status of financial inclusion, regulation

in India. The study based on secondary data using source RBI, World Bank

and IMF. This study explains the current state of financial inclusion, as well

as regulatory changes necessary to make the new architecture for inclusion

viable, including a critique of some of the recommendations of the Mor

Committee on Comprehensive Financial Services for Small Businesses and Low-Income

Households. The study reviews modes of delivery and the regulatory structure

being contemplated or recently introduced. It assesses the suitability

objective envisaged as critical for inclusion, associated challenge of

revamping consumer protection laws, and imperative of improving financial

literacy. The paper also discusses the case of micro, small, and medium-sized

enterprises in the given context.

In short review of literature is indicative of fact that most of

study shows role of financial inclusion in sustainable growth process of

country in general and India in particular with this review of study also

explore that there few work is done on micro level especially in Sonepat

district so there is ample scope of future research in dynamic character of

financial inclusion

3. Objectives of the Study

The main objective of the study is to

analyse the impact of financial inclusion in urban and rural area of Gohana

Block of Sonepat District in Haryana. With this following is supportive

objective:

·

To analyse general

profile of household in selected area.

·

To make a comparison of

banking behaviour of urban and rural area.

·

To make a comparison of

loan behaviour and other financial services in the selected areas.

·

To examine the issues and

challenges behind financial inclusion in this areas.

·

To provide suggestions

for further policy implication.

4. Research Methodology

To

endeavour the above objectives study is conducted in one city and one village

of Gohana block of Sonepat district in Haryana, so that comparison of impact of

financial inclusion in urban and rural area can be made. The sample is

generated through multistage random sampling. At a very first stage one

district is randomly selected in all 21 district of Haryana i.e. Sonepat. Then

at second stage one block is randomly selected from all seven blocks of Sonepat

that is Gohana. At the third stage one village i.e. Barota and one city that is

Gohana is randomly selected. Total of 10% of total household is sampled. So

sample size is 300 households, 100 from village and 200 from city for required

research. The survey schedule technique of primary data is used to collect the

information from respondent in selected area.

The analysis is done through table using simple frequency and

percentage.

5.

Findings of the study

Table 1: General Profile of Respondent in Selected

Rural and Urban Area

|

Characteristics

|

Rural Frequency

|

Rural Percentage

|

Urban Frequency

|

Urban Percentage

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

1.

Place of Survey

Gohana

Barota

2.

Gender of respondent

Male

Female

3.

Age of respondent

0-20

20-35

35-50

Above 50

4.

Occupation

Education

Farmer

Self

employed

Service

|

00

100

68

32

00

32

55

13

00

52

27

21

|

00

100

68

32

00

32

55

13

00

52

27

21

|

200

00

115

85

00

97

70

33

00

37

98

65

|

100

00

57.5

42.5

00

48.5

35

16.5

00

18.5

49.5

32.5

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source:

Field Survey

Table

1 reveals the general profile of selected urban and rural area in Gohana

block of Sonipat district. The figures show that male respondents are more in

both areas in comparison to female respondents. Figures also represent that

almost 80% respondents lie between the age group of 20-50 in which 50%

respondents are young blood but farmer in rural area and self employed in

urban area. In short general profile shows that most of samples respondents

are young population having agriculture occupation in rural area and self

employed in urban area.

Table

2: Bank Account Status of Respondents

in Selected Area

Source:

Field Survey

Table

2 explores the status of bank account in rural and urban areas. Figure shows

that almost 80 percent households have bank in both rural and urban area with

one account. Only 20 percent households have more than account and in gernal

household having saving for their day-today financial activities. Figures

also reveals that rural people make less visit to bank in comparison to urban

people. With this 70 percent respondent also reported that they have not

faced in any problem in opening of an account in bank. Pensions and LPG

subsidies is main reason of opening of an account in both urban and rural

areas. In short, figures represent that people are integrated with banking

facilities in rural area also but less in comparison to urban area in usage

frequency of bank.

Table

3: Loan Behaviour of Respondents in Rural and Urban area

Source: Field Survey

Table 3 represents loan behaviour of

respondents in both rural and urban area. Figures explore that 69%

respondents in rural area and 62 % in urban area reported that they never

took loan from bank. Respondents who are availing loan also reported that

share of money lenders as loan provider is declining with the reason that low

interest rate of bank and its convenience. In loan types, personal loan is on

top in rural area and vehicle loan in urban area. It is also observed that

rural population is not availing housing or education loan whereas urban

population is availing all types of loan. In short, figures reveal that urban

population is more aware about banking facility and also making use of

it.

Table 4: Usage of Other Financial Services in Rural and Urban

area

Source: Field Survey

Table

4 shows uses of other financial services of bank in selected area. Figures

presents that households are also making use of other financial services in

which insurance is leading in both areas followed by debit card an credit

card. Whereas credit card is used by urban population more. In insurance

types, vehicle insurance is leading in both areas and followed by life

insurance and health insurance. Respondents are reported that family and

friends is main source of advice in both areas. Figure also reveal that 100%

respondents reported that they don’t have financial adviser centre are not

available for their queries about financial services and their uses in both

areas. In conclusion, urban population is availing more financial services in

comparisons to rural one.

Table

5: Impact of Financial Services on Respondent in Selected Area

Source:

Field Survey

Table

5 represents impact of financial services in selected areas. Figures show

that 90 % respondents reported that they did not have any asset created

through banking sport in rural area and 75% in urban areas. It is also

reported that in rural area households have assets in form of diary, farming

and fisheries equipments followed by vehicles, whereas in urban areas entertainment

equipment is leading followed by business start-up equipments. Figures also

reveals that urban population is more interested in keeping assets through

bank loan. Whereas for rural population it is not a part of their culture. In

conclusion urban population is more linked to banking facilities usage.

Issues

and Challenges of Financial Inclusion

There

are several issues, challenges and strategies to achieve the target of complete

financial inclusion: -

1. Change in the approach of banks:

Only access to credit

or banking is not the financial inclusion. It is often notices that mere

opening a bank account is taken or claimed as achieving the target of

financial inclusion. Many empirical studies and usage analysis reveals that

after opening such bank accounts, hardly there are any transactions take

place in such bank accounts. Bank must genuinely strive to provide the

directed services under the scheme of financial inclusion to the rural

population, since they are the main pillars for the desired success.

2.

Relaxation in regulatory Framework:

The RBI, in

November 2005, set the population benchmark, which will help it, for taking

its financial inclusion drive to the next level, mandating all banks to reach

out the villages, all habitations with population in excess of 2000. The RBI

asked banks to provide the zero-balance facility in the basic banking

accounts along with ATM-cum-Debit cards without extra charge.

3. Self Help Group-Bank Linkage Programme:

In the last two

decades, the major institutional innovation in India for expanding financial

system access and usage for the poor and marginalized sections of the

population has been the SBLP. The project provided a cost-effective SBLP

model for providing financial services to the underserved poor. Being a

‘savings-first, credit later’ model, credit discipline became a norm for Self

Help Groups (SHGs) and ‘social collateral’ made them bankable.

4.

Microfinance Institutions (MFIs):

The

MFIs have served the underserved populace in the last few years and improved

access to credit though there have been quite a few debatable issues on the

style of corporate governance and ethics of conducting business on part of

some of the MFIs. However, it has been often realized that the MFIs do help

in financial deepening and can remain an important segment of the Indian

financial market keeping in view the present level of penetration of the

banking system.

5. Product Initiatives:

To

ensure that more and more people come within the banking fold the banks

should offer all the customers a ‘basic savings deposit account’ with certain

minimum common facilities and without the requirement of minimum balance. The

services provided in this account should include deposit and withdrawal of

cash at the bank branches as well as ATMs, receipt/credit of money through

electronic payment channels or by means of deposit/collection of cheques

drawn by Central/State Government agencies and departments. Innovation of

products for the specific needs of the poor is necessary for achieving the

ultimate objective of inclusive growth.

6. Mobile

Banking:

With the rapid growth in the

number of mobile phone subscribers in India, banks in collaboration with

telecom companies are seeking to develop an alternate channel of delivery of

banking services. Keeping in view the issues relating to diversity of network

providers in India, remittance centric approach of such model and Know Your

Customer

(KYC) related concerns, the RBI has advocated bank-led mobile banking model

and issued operative guidelines to banks for effecting mobile-based banking

transactions. The empirical studies indicate that banks are yet to fully

exploit this technology even for their existing customers. The banks and the

mobile operators reach a workable understanding while protecting their mutual

interests. Such an approach would result in a ‘win-win’ situation for both

and, more importantly, serve the larger cause of public good of financial inclusion.

7. Aadhaar-enabled

Payment Systems (AEPS):

The

AEPS having the ability to service customers of many banks based on the

unique biometric identification data stored in the Aadhaar database is

expected to empower a bank customer to use Aadhaar as his/her identity to

access the respective Aadhaar enabled bank account and perform basic banking

transactions like balance enquiry, cash withdrawal and deposit through the

BC. A pilot scheme in four districts of Jharkhand is currently being carried

out under which MGNREGA wages to labourers are credited to their Aadhaar

enabled bank accounts.

8. Innovative

product lines & processes:

Banks

have to look at their policies and procedures to develop new product lines

rather than merely adopting the complex products of urban India in the rural

milieu.

9. Financial

literacy and awareness:

There

is a strong concern about the pathetic attitude of the banks to arrange

regular campaigns for spreading awareness about financial inclusion and

financial literacy need to be intensified. Banks need to do efforts in this

area through innovative dissemination channels including films,

documentaries, pamphlets and road shows.

10. Customer

service and consumer protection:

Customer

service is another issue that needs closer attention. Mind-set, cultural and

attitudinal changes at the grass-root levels and user friendly technology at

the level of branches of banks and BC outlets are needed to extend holistic

customer service to the new entrants to the banking system.

7. Conclusions:

It

is concluded that financial inclusion as a process of ensuring access to

financial services and timely and adequate credit for needed and vulnerable

section of society at an affordable cost is very important for the growth and

development of the any nations. The results of the study show that male

respondents are more in both areas in comparison to female respondents.

Figures also represent that almost 80% respondents lie between the age group

of 20-50 in which 50% respondents are young blood but farmer in rural area

and self employed in urban area. In short general profile shows that most of

samples respondents are young population having agriculture occupation in

rural area and self employed in urban area.

Findings also show that almost

80 percent households have bank in both rural and urban area with one

account. Only 20 percent households have more than account and in general

household having saving for their day-today financial activities. Figures

also reveals that rural people make less visit to bank in comparison to urban

people. With this 70 percent respondent also reported that they have not

faced in any problem in opening of an account in bank. Pensions and LPG

subsidies is main reason of opening of an account in both urban and rural

areas. In short, figures represent that people are integrated with banking

facilities in rural area also but less in comparison to urban area in usage

frequency of bank.

Study also explores that 69% respondents in rural area and 62 % in

urban area reported that they never took loan from bank. Respondents who are

availing loan also reported that share of money lenders as loan provider is

declining with the reason that low interest rate of bank and its convenience.

In loan types, personal loan is on top in rural area and vehicle loan in

urban area. It is also observed that rural population is not availing housing

or education loan whereas urban population is availing all types of loan.

In short,

figures reveal that urban population is more aware about banking facility and

also making use of it. Figures

presents that households are also making use of other financial services in

which insurance is leading in both areas followed by debit card an credit

card. Whereas credit card is used by urban population more. In insurance

types, vehicle insurance is leading in both areas and followed by life

insurance and health insurance. Respondents are reported that family and

friends is main source of advice in both areas. Figure also reveal that 100%

respondents reported that they don’t have financial adviser centre are not

available for their queries about financial services and their uses in both

areas. In conclusion, urban population is availing more financial services in

comparisons to rural one.

8.Suggestions:

For achieving complete financial

inclusion the RBI, Government, NABARD and the implementing agencies will have

to put their minds and hearts together so that the financial inclusion can be

taken forward. There should be proper financial inclusion regulation in our

country and access to financial services should be made through SHGs and

MFIs. Thus, financial inclusion is a big road which India needs to travel to

make it completely successful. Miles to go before we reach the set goals but

the ball is set in motion.

Financial Inclusion should be taken as a

business prospect rather than compulsion so that probable business opportunity

can be utilized by tapping and targeting untapped and unorganized

market. The RBI and commercial banks

should plan a coordinated campaign in partnership with the trainers and

professional to educate customers about the basic financial products,

services and offerings. For building

customer awareness E-banking and M-banking training and education programme

should be conducted.

Following

suggestions are to be implemented in India for enhancing the financial inclusion:

· Government should increase number of banks branches in remote

areas.

· Banks should focus more

on products which should be simple, affordable, and should have high utility.

· RBI should frequently

check whether the financial products are actually utilized by customer

effectively, if not it should analyse the reasons.

· Banks should do regular

surveys in villages for understanding the financial needs of the people.

· NGOs and other not for

profit organisation/ social organisations / Non Governmental organisations

etc. may be involved more to propagate the financial services to the remote

and non accessible areas.

· Banks should allow

customers to provide feedback about the product services.

· R B I should allow

service providers to provide better mobile banking products at affordable price.

· Micro Finance Organisations/ Non Banking Financial organisations

may be given permissions to do limited financial services in remote areas.

· Enlist many

intermediaries/ agents with incentives to facilitate popularising financial

products in remote areas.

· Opening of Bank

Accounts without minimum balance condition should be allowed at all branches

and places.

References

Barua, A.,

Kathuria, R. and Malik, N. (2016), “The Status of Financial Inclusion,

Regulation, and Education in India,” ADBI Working Paper 568

Damodar, Akhil

(2011), “Financial Inclusion: Issues and Challenges,” AKGEC International

Journal of Technology, Vol. 4(2)

Dangi Neha and

Kumar Pawan (2013), “Current Situation of Financial Inclusion in India and

its Future Visions,” International Journal of Management and Social Sciences

Research, vol. 2(8)

Gandhi,

M.(2013), “Financial inclusion in India: Issue and Challenge,” International

Multidisciplinary Journal of Applied Research, Vol.1(3)

Hastak, Anuradha

and Gaikwad, Arun (2015), “Issues Relating to Financial Inclusion and Banking

Sectors in India,” The Business and Management Review, Vol.4 (4)

Massey, Joseph

(2010), “Role of Financial Institutions in Financial Inclusion,” FICCI’S

Banking and Finance Journal.

Paramasivan, C. And

Ganeshkumar, V. (2016), “Overview of Financial Inclusion in India,” Imperial

Journal of Interdisciplinary Research, Vol.2 (3)

Swain, K.(2008),

“ Financial Inclusion of Rural Markets: Understanding the Current Indian

Framework,” Indian Institute of Management Calcutta, Working Paper Series,

WPS No.630/October 2008.

Sharma, Mandira

(2010), “Index of Financial Inclusion,” Centre of International Trade and

Development

Shankar, Savita

(2013), “Financial Inclusion in India: Do Microfinance Institutions Address

Access Barriers,” ACRN Journal of Entrepreneurship Perspective, Vol. 2(1),

P.P.60-74.

Sharma, A.,

Kukreja, S.(2013), “ An Analytical Study: Relevance of Financial Inclusion

for Developing Nations,” International Journal of Engineering and Science, 2(6),

15-20.

Shastri, Aditya

(2014), “Financial Inclusion in Madhya Pradesh, A Study with Reference to

Rural Population,” Journal of Business Management and Social Sciences

Research, Vol.3 (12)

Thorat, Usha

(2007), “Financial Inclusion – The Indian Experience”, Reserve Bank of India,

Speeches

Tamilarasu, A.

(2014), “Role of Banking Sectors on Financial Inclusion Development in India

– An Analysis,” Galaxy International Interdisciplinary Research Journal,

Vol.2 (2)

Www.Wikipedia.Com.

Appendix

QUESTIONNAIRE ON FINANCIAL INCLUSION

Name of investigator:

A.

SAVING:

1. Is your household having a bank

account? Yes / No

2. No. Of accounts in your

household: ( ) 1

( ) 2 (

) 3 ( ) 4 or more than 4

( )

3. Which type of account do you have?

a) Saving account b) Current

account

c) Recurring account d) Fixed

deposit account

e) If other, please specify

4. Purpose of opening account:

a) Saving/ Banking

b) Due to loan account

c) For MNREGA payment

d) Other DBT payment

5. Frequency to visit bank:

a) Once in a week

b) Once in 15 days

c) Once in a month

d) Never after opening

e) Using ATM

f) Using internet banking

6. Problem faced in opening bank:

a) Distance from bank

b) Rush in bank branch

c) Illiteracy

d) Family problem

e) Any other

f) No problem faced

7. Any member of family received any

payment in bank a/c: Yes / No

8. If yes than what type:

a) Scholarship

b) Old age pension/ Widow pension / Handicapped pension

c) LPG Subsidy

d) Salary

e) Any other specify

LOAN

1.

Have your household ever borrowed or taken loan: Yes / No

2. If yes, from where?

a) Banks

b) Relatives

c) Moneylenders

d) If other, please specify

3. If borrowed from bank, which of the

following reason led to this choice?

a) Low rate of interest

b) Was offered/ arranged by the banks

c) It is easy

d) Trustworthy lenders

e) If other, please specify

3. If ever borrowed, what was the type

of the credit / loan?

a) Housing loan

b) Business loan

c) Education loan

e) Vehicle loan

f) If personal loan

Other

Financial services

1. Are you using any other form of

financial services or product?

a) No

b) If yes, then which one: Insurance

( )

Credit card ( ) Debit card

( )

2. If already having insurance, which of

the following type is it?

a) Life insurance

b) Health insurance

c) Vehicle insurance

d) If other, please specify

3. Over the past couple of years, have

been anywhere for taking advice about money matters?

a) No

b) Family/ Friends

c) Bank

d) Financial advisor

e) Social worker

4. Is there any financial advice centre/

credit counselling centre in your area?

Yes / No

5. What would you do if you needed money

in an emergency?

a) Ask family or friends

b) Take out a bank loan or overdraft

c) Take out loan from the other

sources

d) Use credit card

e) Sell something

f) Draw on savings

g) If other, please specify

6. Are you feel the need of a bank

branch at your place? Yes/ No

7. What do you think that the

Government, local bodies, banks, NGOs and others might need to do to further

achieve financial inclusion?

Impact

of financial inclusion

1.

Productive asset created with support from bank loan: Yes/ No.

2. Name of the productive assets:

a) Dairy animals / Farming equipments /

Fisheries

b) Transport vehicle

c)

Shop

d) Start any business

e) Entertainment equipments

e) Any other, please specify

3.

Would you like to acquire, if bank loan is provided? Yes / No.

4.

Why you don’t need these assets?

a)

No need

b)

Cannot afford

c)

Available on rent

d)

Bank loan is not available

e)

Any other please specify

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||